I am looking for a Long opportunity in AUD/CAD.

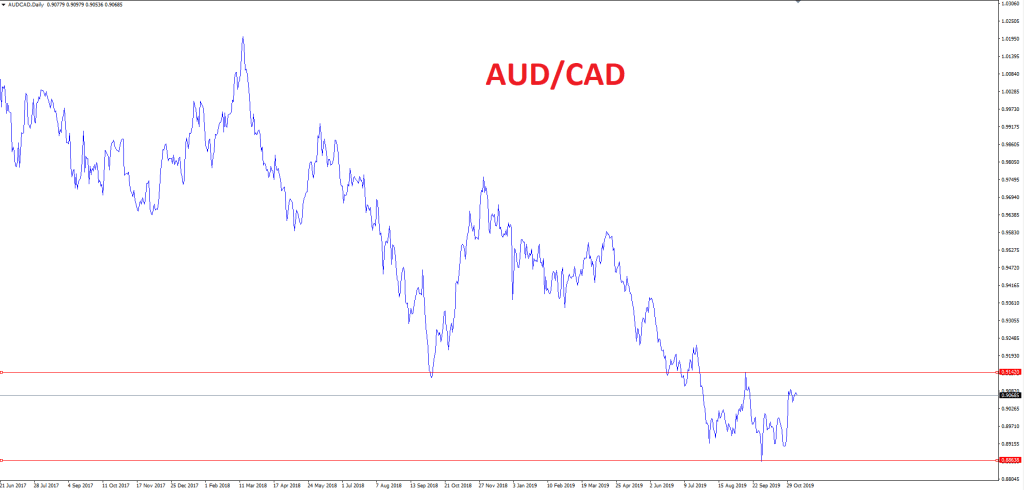

In this chart, you can see we had a nice downtrend on this pair. We started on the 14th of March 2018 at 1.0202 and we reached the bottom (maybe) on the 1st of October this year at 0.8850.

Now, I am expecting a bounce-back, bear in mind we are talking about longer-term positions, definitely not intraday opportunities ( in this instance 3 weeks to 2 months).

I am looking at the macro data that are going to be published in the next 2 weeks, and if these data are good for the pair I will be positioning the first tranche of my size long.

As per the economic calendar, on the 13th of November, the ABoS will publish the Wage Price Index data which I consider a leading indicator of consumer inflation, in fact when businesses pay more for the labour the higher costs are usually passed on to the consumer.

The previous release was 0.6% and the forecast for this quarter is 0.5%, a release greater than 0.5% should be good for the AUD.

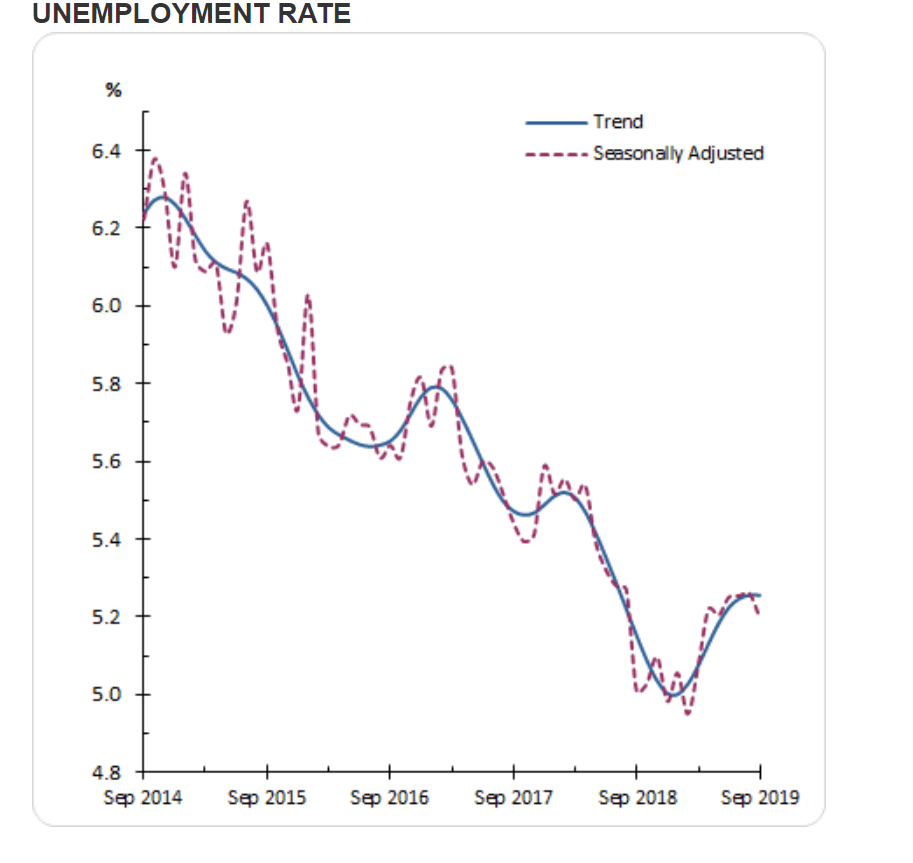

Although it’s generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labour-market conditions, if fact, next week’s unemployment rate is in the spotlight as well. Banks are expecting a value of 5.2% as well as the previous release, but an actual value lower than that could be seen as an interesting catalyst for a bounce-back movement.

Anyway, with very HIGH probability this value will remain steady.

On the other end, we have the speech of Stephen S. Poloz, governor of Bank of Canada that during one of his latest statements said :

” Governing Council is mindful that the resilience of Canada’s economy will be increasingly tested as trade conflicts and uncertainty persist. In considering the appropriate path for monetary policy, we will be monitoring the extent to which the global slowdown spreads beyond manufacturing and investment. In this context, we will pay close attention to the sources of resilience in the Canadian economy, notably consumer spending and housing activity. We will also be watching for any changes to fiscal policy at the federal level now that the election is behind us. “

This was the 30th of October in Ontario, and it makes you think about the Canadian situation that not surprisingly, took into consideration the worsening global situation as the primary issue for Canada at this point.

BOC Governor Stephen Poloz will have his speech at 3.45 AM. This is in fact, very important. As head of the central bank, which controls short term interest rates, he has more influence over the nation’s currency value than any other person.

In conclusion, if the fundamentals will agree with me, and technically speaking the level of 0.9150 is going to be broken I will go long on the pair.

I hope you enjoyed this article.

Follow me on Instagram and drop me a DM if you liked it.

IG : Mirko_rko

Disclaimer The presentation is intended for educational purposes only and does not replace independent professional judgement. Statements of fact and opinions.